Gift tax rates vary based on the region where the gift is registered and range between 3 and 7. Refer to the following information before make an option.

Inheritance Taxation In Oecd Countries En Oecd

Inheritance tax in Malaysia was abolished in 1991.

. According to this website the top 1 of American households earns USD430kyear and get taxed 35 while Malaysias top 1 household earns RM300kyear but get taxed only 245. Elaborating on capital gains tax Koong said the new proposed tax system would spook. In this case Mei Li would net in RM 335550 from the sale of her inherited property after incurring RM 3500 in legal fees and RM 10950 in RPGT 2020.

Inheritance estate and gift taxes. Costa Rica does not have an inheritance tax. US Federal Income Tax Rate.

Lifestyle expenses internet newspapers books smartphones tabletscomputers sports equipment gymnasium fee and electronic newspapers maximum 2500. This declaration is a counter check measure to ensure compliance of the Malaysian tax law in line with Malaysias commitment to the Automatic Exchange of Financial Account Information with other tax jurisdictions. Study fees for acquiring post graduate study at recognised institutions or professional bodies in Malaysia for the purpose of acquiring any skill or qualification - maximum 7000.

RPGT 2020 Rate Applicable. Inheritance tax is imposed on the assets inherited from a deceased person. The rate of both sales tax and service tax is 6.

Property tax is levied on the gross annual value of property as determined by the local state authorities. Donation tax due to the local municipalities in the range of 33 to 66. Malaysia Income Tax Rate.

That means income inequality may not be guaranteed. Joolah makes it easy for you to get in touch with a tax expert to help you with any tax related matters. There are no net wealthworth taxes in Malaysia.

These biological kids may or may not have a share in inheritance when it comes to those kinds of things. However it was abolished 1991. In Malaysia only the state government has the power to grant permission for a foreigner to own and inherit a property.

After 1MDB scandal and now Covid recession isnt it high time for wealthinheritance tax. Ad Find Relevant Results For Is Inheritance Taxable. Some states and a handful of federal governments around the world levy this tax.

There are many factors that have caused this economic inequality gap in any country including Malaysia such as lack of educational opportunities and loss of jobs due to globalisation and. Taxation Researcher April 04 2022. Though inheritance tax may be good for the Malaysian economy and government revenue it may not be 100 effective.

In the case of a inherited property stamp duty might become a consideration. It may also not push property ownership up. An estate s of a dead person is liable to a 5 tax if it is valued above RM2 million and 10 if it is above RM 4 million.

Varamus Is The Newest Place to Search. There are no inheritance estate or gift taxes in Malaysia. Taxes arent usually involved but inheritance tax applies to inheritances worth more than 25000.

The tax rate on inheritances depends on. Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax. At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10.

This means that Malaysia has managed to reduce its income inequality level to that of a developed country like the USA without needing inheritance tax. Inheritance tax will be imposed on the propertys current market value. Malaysia or 2 if there is none not relevant.

Searching Smarter with Us. At the time assets of a. Varies depending on category of the heir and the amount of the inheritance.

No inheritance or gift taxes are levied in Malaysia. Elaborating on capital gains tax Koong said the new proposed tax system would spook. In laymans terms an inheritance tax was executed in Malaysia under the Estate Duty Enactment 1941.

Everything You Need To Know. If that is the case Mei Lis applicable RPGT rate shall be 20 instead of 30.

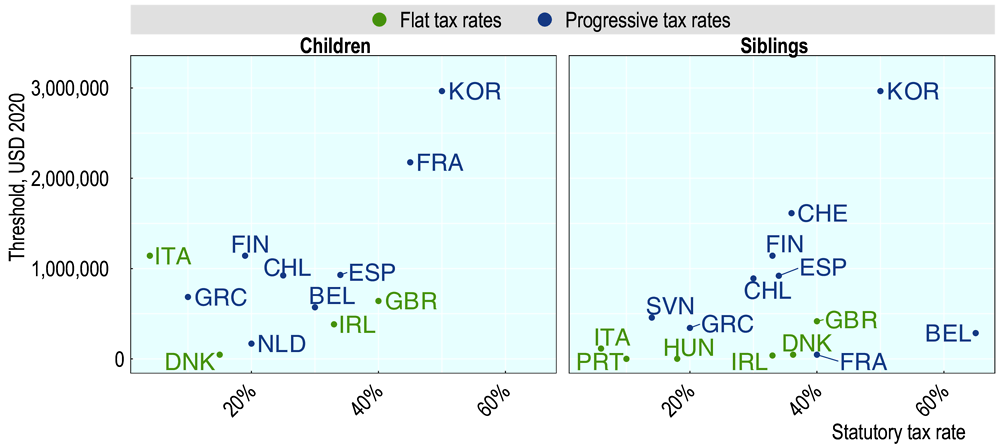

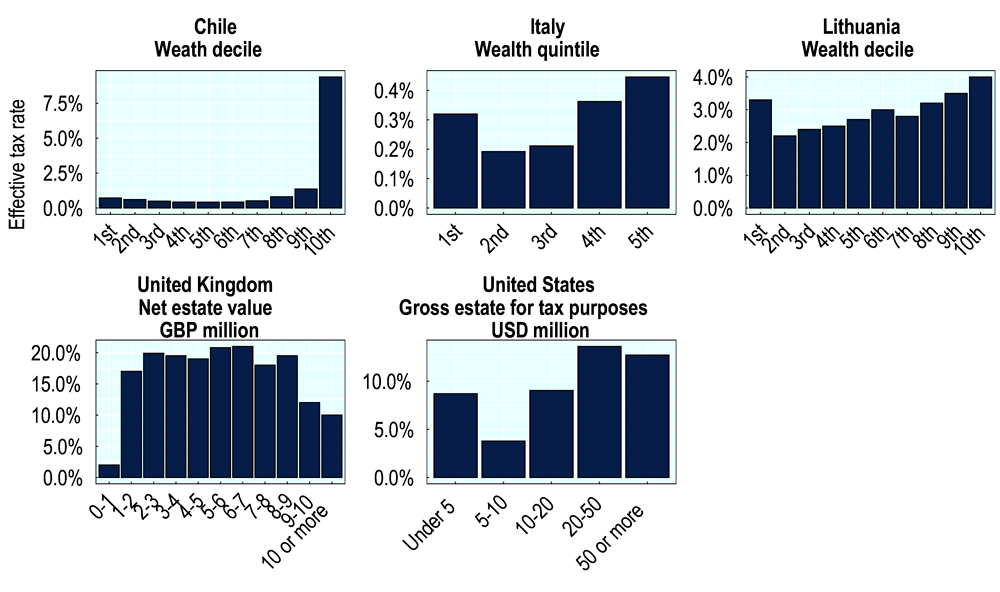

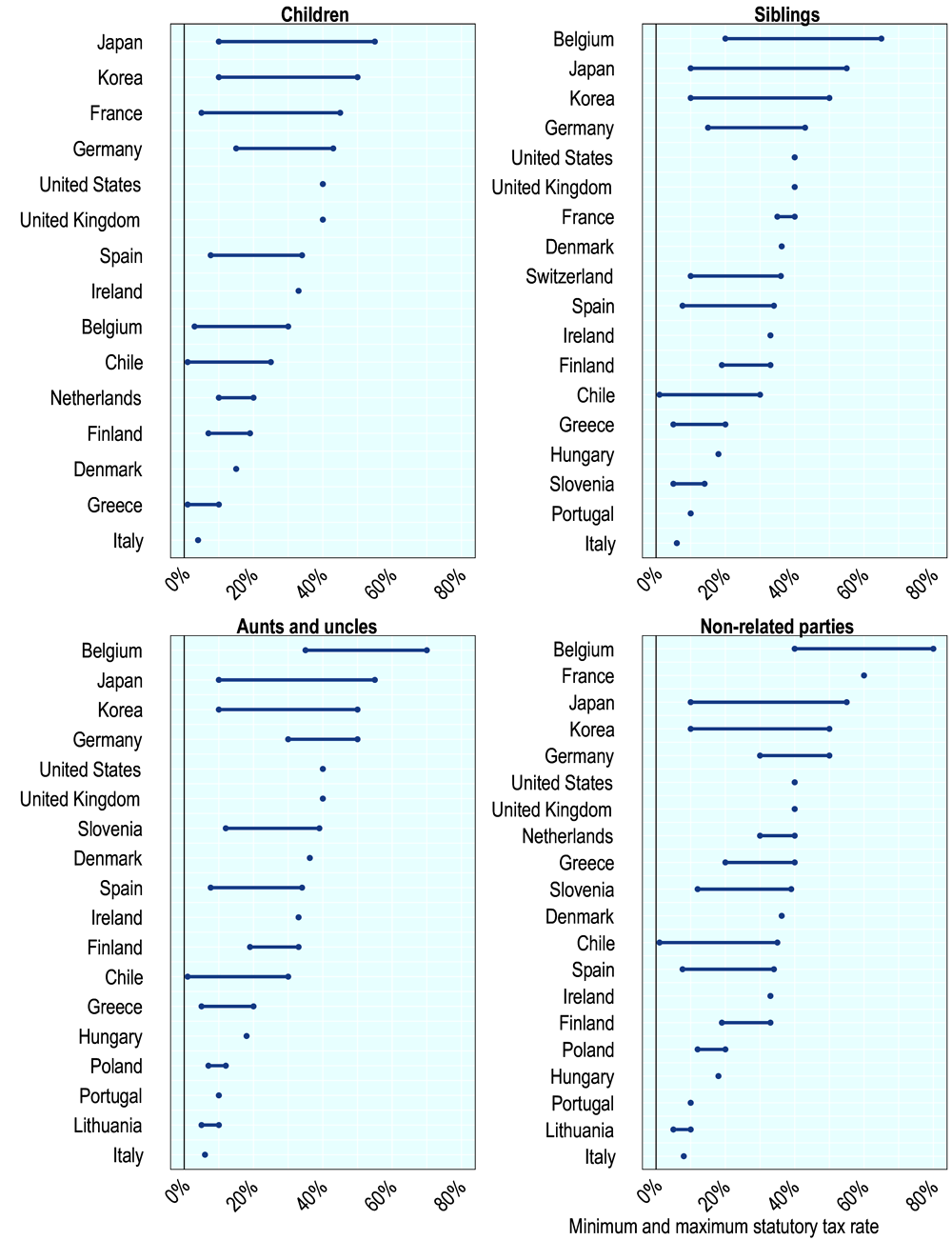

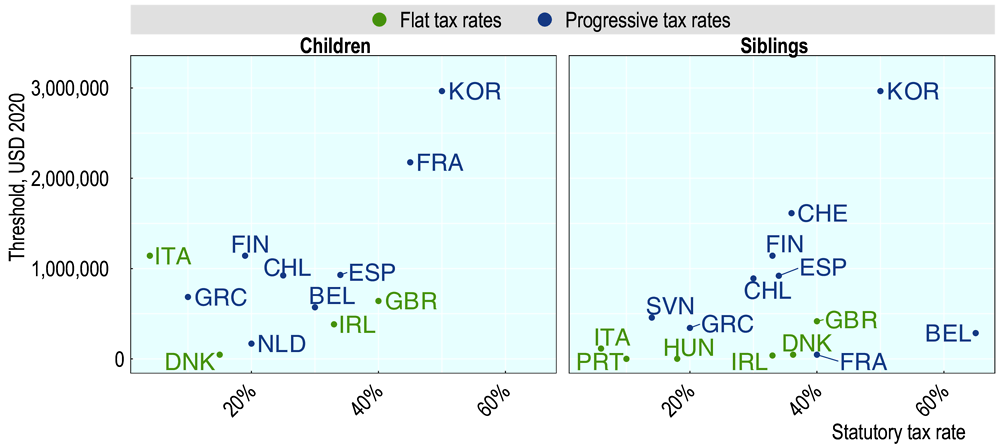

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Italian Inheritance Taxes Studio Legale Metta

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

Tax Experts No Need For Capital Gains Inheritance Taxes

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Bkash Mobile Money Job Opening Good Communication Skills Job

保险的价值 When Some One Pass Away Our Asset Including Bank Account Etc Will Be Frozen By Government Our Family Need To Pay Inheritance Tax Before We Can Claim

Understanding Inheritance And Estate Tax In Asean Asean Business News

1 025 Inheritance Tax Photos Free Royalty Free Stock Photos From Dreamstime

1 Nov 2018 Budgeting Inheritance Tax Finance

1 Nov 2018 Budgeting Inheritance Tax Finance

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Budget 2020 It S Time For Wealth And Inheritance Tax

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary